What to Look for When Buying a House

Starting a home search can feel a little like wandering into a forest: There are so many places to wander and so much possibility waiting.

And while we all like to dream and wander, getting serious about finding a home to buy will eventually require a series of choices based on what’s possible and practical.

Most buyers start to narrow their search by price so they’re looking only for homes they can afford. As they start to tour online or in person, they develop a sense of the market, what’s available and what’s appealing to them.

If you’re looking to buy a home, here are some general rules that can help you find a home that works for you now and in the future.

What are the top features buyers look for in a home?

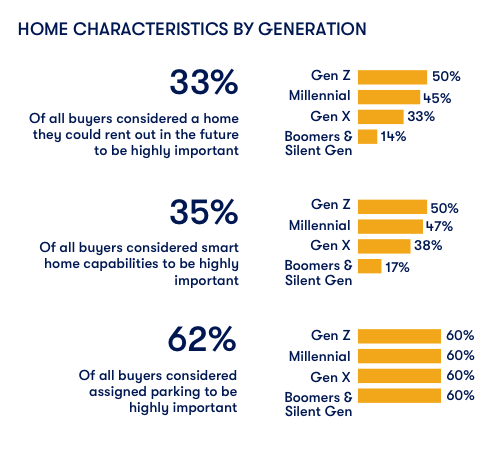

Today’s buyers are juggling many different priorities when it comes to buying a home, but, according to the Zillow Group Consumer Housing Trends Report 2020, some features stand out as very important or extremely important to most buyers.

Neighborhood wants and needs for buyers

The following neighborhood qualities ranked high in importance for buyers:

- Feels safe: 83% say a feeling of safety is very or extremely important

- Walkable: 66%

- Preferred neighborhood: 60%

- Proximity to shopping, services and/or leisure activities: 58%

- Optimal commute to work or school: 53%

- Offers a sense of community or belonging: 51%

- Close to family and friends: 50%

- In preferred school district: 44%

Home features buyers want

When it comes to home features, the following were very or extremely important to a majority of buyers:

- Within initial budget: 82% of buyers cite budget as very or extremely important

- Air conditioning: 79%

- Preferred number of bedrooms: 77%

- Preferred number of bathrooms: 72%

- Private outdoor space: 72%

- Floor plan/layout that fits preferences: 72%

- Preferred size/square footage: 69%

1. Search for the right price

Price will ultimately dictate what you can buy. While looking at homes above your price range can be fun and provide you with a sense of the market, it also can set you up for disappointment if you fall for a home outside your price range. Still, Zillow research found that 27% of buyers went over their initial budget. Only 17% spent less than they budgeted.

How to set your home buying budget

Use Zillow’s Affordability Calculator: Use this handy tool to establish a budget range based on your income, monthly bills and down payment amount. You also can set up Zillow alerts for listings that fall within your price range.

Get pre-approved: A lender can pre-approve you for a loan up to a specific amount, based on your income, debts and credit history.

Forecast your mortgage payment: Use Zillow’s mortgage calculator to estimate your monthly payments. The calculator adds in estimates for taxes, homeowners insurance and any homeowner association fees so you have a more accurate picture of what your monthly mortgage costs will be.

2. Prioritize the location

Location is one of the most important things to consider when buying a home, but 23% of buyers report finding it difficult or extremely difficult to find a home in their desired location.

If you can’t find or afford a home in your ideal neighborhood, work with your agent to determine what is most important to you so you can find a location that best suits your lifestyle, needs and budget.

Here are a few things to consider:

Proximity to downtown

Homes closer to core downtown areas tend to be more expensive, thanks to their shorter commutes. According to Zillow research, in 18 of the 35 large metro areas included in the analysis, buyers should expect to pay more for a home within a 10-minute rush-hour drive to the downtown core. However, keep in mind that home values in this bracket are also growing more slowly in much of the country as more buyers shift to remote work and place a lower value on shorter commute times. In 2017, homes in 9 of those metro areas had the fastest growing home values — that has since dropped to three.

Community attributes

If you want the ability to walk to restaurants and shops, see if you’ll be close enough by walking or biking the distance to town. Spend time exploring the area, checking out nearby parks and nearby attractions.

If you prefer solitude and don’t mind driving, consider homes that offer more privacy, perhaps in locations off the beaten path.

School district quality

Zillow understands that a parent looking for a new home wants to do everything they can to ensure the best possible educational situation for their child, and choosing a home that feeds into schools that support their children in all the right ways is part of that process. The full process, however, requires a bit of homework. You should visit the local schools to gather your assessment of the education and programs. Even if you don’t have children, a potential positive relationship between school quality and home value also interests a broad spectrum of home shoppers.

Flood zone status

Homes located in high-risk flood zones require special insurance coverage beyond the typical homeowners policy.

Home orientation on property

Think about what the daily experience of living in the home might feel like. Does it get enough sunlight -- or too much? Are you a comfortable distance from the neighbors? Consider the distance and difficulty of traveling from the driveway to the front door and whether seasonal changes will turn features like a steep driveway into a hazard.

3. Think long term

Zillow research shows that the typical homeowner stays in their home for 14 years before selling. When shopping for a forever home, think beyond your immediate needs. Make sure the home meets your long-term goals and plans.

Bedrooms and bathrooms

If you plan to grow your family in the near future, make sure the new home can accommodate your plans, whether it’s an extra room for a new child, an in-law suite for parents or a guest bedroom for visitors or rental income. If you plan to work remotely, consider whether you need designated office space or a flexible space that can serve as a work space. If you’re transitioning to retirement, think about how much space you’ll want.

Outdoor space

Most buyers consider outdoor space important. Do you want a place for parties, kids and pets? How about a garden? Do you want private space or close proximity to a park or community garden? Make sure the home’s yard or outdoor spaces meet your needs.

Potential to personalize

Many buyers look for a home that’s move-in ready, so they can avoid costly repairs and updates — especially right after moving in. Many also like to add some personal flair. If you want to infuse the home with your personal style, you might want to avoid homes that can’t be changed enough to fit your preferences or those with recent upgrades that are selling for top dollar. (To see what constitutes minor repairs, see below.)

Lifestyle amenities

You probably want your new home to enhance your current lifestyle — and are probably envisioning what life in a new home might look like. As you evaluate homes, consider your hobbies and what makes you happy. For example, if you love to cook, pay special attention to the kitchen. If you like to run for exercise, are there trails or pleasant streets to traverse? Think about your current living situation, what you love about living there and what you would change.

4. Assess property condition

Television makes home renovations look easy, but in reality, they can be anything but. If you’re a first-time buyer who has never undertaken a home project, you may want to steer clear of a home in serious disrepair. The costs can add up quickly, and if the home needs structural work, it could delay your move-in, causing unnecessary stress. Here are the three major categories of property condition.

Move-in ready

A move-in ready home is new, close to new, or has been recently renovated. Such homes also may be called “turn-key.”

Needs repairs

A home that needs minor updates might have cosmetic issues you’d like to change, or have some dated mechanical systems that could be updated for energy savings. If you’re curious, consult with a contractor to get an idea if upgrades are affordable for you.

A home in need of major repairs is often priced lower than other similar homes due to money and time it will take to improve it. You might enjoy personalizing the home, but consider that the return on investment for a major renovation isn’t 100% and extensive repairs could delay your move-in date. If you find a home in great condition with the exception of an outdated kitchen or bathroom, you could update the space while living there or move out briefly while the work is being done.

Check condition of costly systems

Regardless of a home’s condition, make sure your inspector checks major systems and mechanicals in the home to ensure they’re in working order. If the inspector finds issues, consider asking the seller to repair them before closing or offer you a credit so you can fix them yourself. Be especially alert for the following issues, which can cost thousands to repair or replace:

- Damaged roof

- Older furnace or HVAC system

- Flooding, water damage or mold

- Old insulation which main contain asbestos

- Plumbing issues/leaks

- Exterior cracks

- Uneven floors

- Inefficient windows

5. Don't focus on minor cosmetic details

No house is perfect, so try not to get hung up on little imperfections. For example, don’t delete a home from your list just because you don’t like the interior paint color. Cosmetic changes are fairly easy and relatively affordable to make.

Cosmetic repairs generally include:

- Paint

- Hardware

- Furnishings

- Landscaping

When you attend showings and open houses, or even when you’re just browsing photos and floor plans or taking 3D tours, it’s easy to get distracted by clutter. Try not to see beyond the seller’s stuff since it’ll all be removed by the time you move in. Picture the house as a blank canvas for your belongings.

6. Stick with your must-haves

There’s a big difference between wants and needs when shopping for a home, so it might help to create a list for each. For instance, a shorter commute may be a must-have, but smart home features are a nice-to-have.

Needs

- Shorter commute

- Specific number of bedrooms and bathrooms

- Designated parking

Nice-to-have:

- Want: updated kitchen

- Want: upstairs washer and dryer

- Want: smart home features

You may be that lucky buyer who finds a house that checks all the boxes, but chances are you’ll have to make some compromises. .

Comments

Post a Comment